Everything began in 2012.

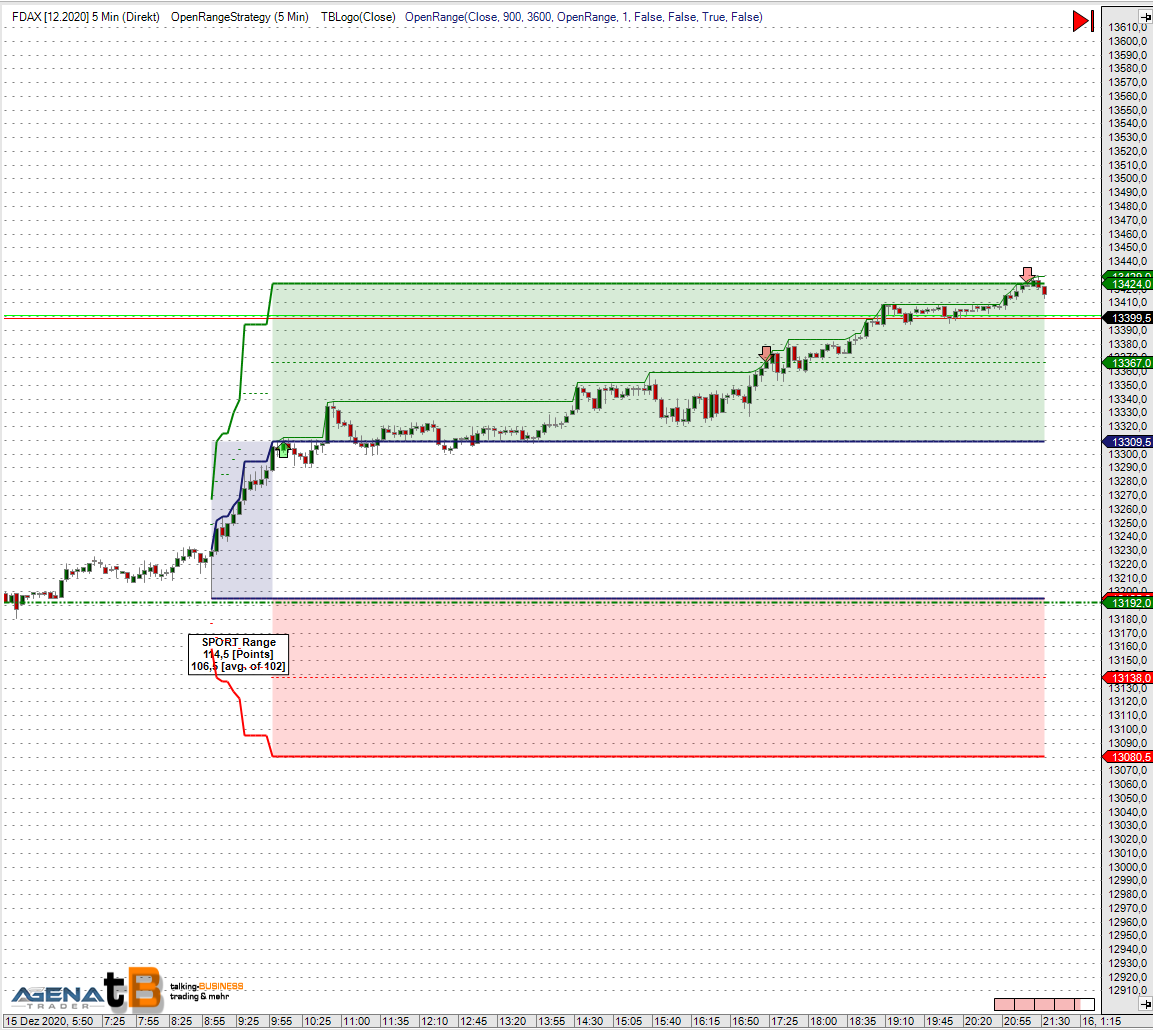

Back then, I started getting interested in so-called 'OpenRange BreakOut' trading. There was plenty of reading material available on the internet, which allowed me to thoroughly explore the relevant approaches and ideas on the subject.

Next, I closely examined the most interesting variations. Combining the essence of these with my own experiences from years of trading in the stock market for private clients and institutional investors eventually led me to create SPORT - Simple Predefined Open Range Trading.

The idea of 'Simple Trading from a Range' was born.

From the beginning, I was fascinated by the concept of an emotionless trading approach with predefined rules for:

- Entry

- Exit

- Risk

There were no more 'excuses' for placing incorrect orders, missing profit-taking opportunities, or enduring significant losses. Everything was firmly regulated with this approach.

Therefore, in 2014, it was only a logical consequence to further refine this trading approach.

I asked myself, 'Why not partially or fully automate a system with such clear rules?'

And so it was done. SPORT, as an addon and trading tool, took shape.

Indicator

I embarked on developing an indicator that could automatically draw the desired ranges on any given asset, saving me from manually calculating potential targets and stop-loss levels.

This already brought about significant time savings, as all parameters were automatically calculated after the predefined range time had elapsed.

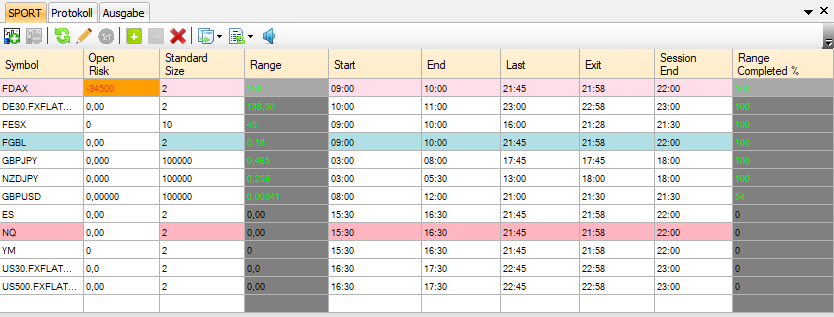

Another advantage was quickly evident: with the help of lists, I could gain an overview of the most interesting ranges for the current trading day in no time.

The strategy

I thought I had everything I needed - or so I thought...

Over time, I realized that as the number of observed instruments increased, so did the effort required to place the necessary trading orders for entry, exit, and stop-loss in a timely manner. It was not uncommon for one asset to move significantly in the expected direction while I was still entering the order for another instrument.

A frustrating feeling indeed.

So, something new had to be introduced, which ultimately was just the logical and consistent evolution of the approach.

If I calculate all the essential values in the indicator, why couldn't the trading system also generate the corresponding orders from it?

The idea for the advanced strategy was born.

What initially sounded quite trivial turned out to be a continuous development over a long period.

Time and again, events occurred that I had not previously considered or anticipated.

An example? - Sure.

What happens if the data feed provider or the stock exchange fails to deliver any or all data temporarily during the necessary period for measuring the range size? This could lead to the calculated range significantly deviating from the actual price movement in that trading period. Consequently, I would have an entirely wrong trading assumption for the entire remaining trading day on that instrument. As a result, a check for data consistency during the range measurement period was implemented.

This was just one of countless occurrences that needed to be avoided.

Over time, it became evident that a seemingly simple strategy could become quite complex when trying to protect against potential eventualities.

Unfortunately, this is often underestimated or neglected by many 'signal providers'.

However, we are not dealing with a gaming app here, where you can lose a level at worst - this is about the trader's money.

In my view, different standards apply, and these are what I always strive for.